Brexit & transition period

After three and a half years of negotiations, Brexit has finally become a reality. The execution of the withdrawal agreement and its entry into force on 31 January 2020, marks the end of the period provided for in Article 50 of the Treaty on European Union (TEU) and the beginning of a transitional period.

Until 31 December 2020, the United Kingdom (UK), which is no longer represented in the institutions of the European Union (EU) and which is no longer a Member State since the withdrawal agreement, will continue to apply EU law. The aim here is to allow the negotiation of agreements with the European Community. This transition period may possibly be extended for one or two years, provided that the parties agree before 1 July 2020.

While the situation between the EU and the UK seems to be the same at the moment, the end of the transition period will be accompanied by many changes.

Free movement of goods: Brexit marks the end of this freedom and the single market for the United Kingdom. At the earliest on 31 December 2020, trade relations with the United Kingdom will take place outside the Customs Union, involving, subject to the outcome of the current negotiations, new customs formalities, export and import licenses, the application of customs duties on goods from the United Kingdom or VAT on imports . French companies (and more broadly from the EU concerned) who export to the UK should get prepared for this new framework.

This involves carrying out all the required administrative procedures but also taking all the necessary decisions, such as e.g. registering the company with the customs authorities in order to obtain the EORI number (Economic Operator Registration Identification number) required for companies importing and exporting outside the EU and the designation of a customs officer . Companies will have to bring their customs procedures into line with any new agreements that may be signed with the UK. If negotiations fail, trade between the EU and the UK will be governed by World Trade Organization standards, with tariffs, quotas and border controls.

Free movement of persons – Immigration: the withdrawal of the United Kingdom from the Schengen area means the end of freedom of movement for European citizens wishing to settle in Great Britain. If visits of less than 6 months, for French and more generally for holders of European passports, will not require a visa, the situation will be very different for workers. The UK government announced that it wants to implement a new immigration system that gives priority to highly skilled workers (Londres donne la priorité aux immigrés hautement qualifiés, Les Echos, 20 Feb. 2020). This new system, which is expected to come into effect in January 2021, would be a point system (as exists in Canada) that will allow each worker wishing to settle overseas and regulate immigration. European citizens, and citizens around the world, would need to have a job offer from an employer recognized by the UK government, a minimum level of skills required, a sufficient level of English and a minimum wage threshold of GBP 25,600 (The UK’s points-based immigration system : policy statement, British government). A point system will also be implemented for students.

- French residents in the United Kingdom

French nationals resident in the United Kingdom, who arrived before or during the transition period, must apply to the UK authorities for the status of (i) settled status for those who have been residing continuously in the United Kingdom for at least 5 years (without absence from the territory for more than six consecutive months per year) or (ii) pre-settled status waiting to meet the residency requirement for those who have been resident for less than 5 years.

- British residents in France

All the rights of British nationals acquired as European nationals are maintained.

Under the withdrawal agreement, UK nationals will have to apply for specific residence permits "UK withdrawal agreement from the EU". The request must be made before 1 July 2021, when British nationals will be required to hold a residence permit.

Creation of free zones: the British government announced at the beginning of February 2020 its intention to create up to ten free ports across the Channel by the end of 2021, duty-free zone on imports of goods as long as they have not left them to enter the domestic market. A public consultation has opened for 10 weeks on this subject in order to determine which cities will benefit from this status (Le Royaume-Uni veut créer une dizaine de ports francs, Les Echos, 11 Feb. 2020).

VAT – towards the end of the reverse charge mechanism: concerning the free movement of goods and services, Brexit will see the end of the reverse charge mechanism of intra-Community VAT. Once the transition period is over, the UK will have to decide how European companies will be allowed to recover UK VAT, what types of services will be involved and what rates shall apply. Refund claims will no longer be submitted electronically, and it seems that a paper submission with original invoices will be required. Also, the deadlines for submission of refund claims should change on 31 December of each year for UK VAT refund claims and on 30 June of each year for UK VAT refund claims to EU countries (Brexit : vers un changement des conditions de remboursement de la TVA britannique, TVA Conseil).

Intellectual Property: Registrations of trademarks and models made before the end of the transition period will benefit from the automatic creation of an equivalent British national title. From 31 December 2020, if the transition period has not been postponed, two hypotheses stand out.

If the trademark or model has been filed and registered before the end of the transition period, it will always benefit from an automatic free creation of the equivalent title without further formality.

If the trademark, or model, has been filed and not yet registered, the English Office invites the applicant to pay a fee in the United Kingdom allowing the creation of the equivalent title of protection. The only uncertainty to date concerns the possibility of a new review of the brand, or model that has not yet been confirmed.

Litigation

- Procedural documents: until the end of the transition period, Articles 4§3 and 9§2 of the REGULATION (EC) No 1393/2007 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 13 November 2007 on the service in the Member States of judicial and extrajudicial documents in civil or commercial matters (service of documents), and repealing Council Regulation (EC) No 1348/2000 shall continue to apply. The summons (or any other document that must be served) are for the moment still sent by the French judicial officer (“huissier”) to the High Court – Queen’s Bench Senior Master, Foreign Process Section Royal Courts of Justice. The latter is then responsible for notifying the document to the person concerned.

- Enforcement of judgments: REGULATION (EU) No 1215/2012 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 12 December 2012 on jurisdiction and the recognition and enforcement of judgments in civil and commercial matters will cease to apply when the United Kingdom has definitively left the EU. In view of the importance of economic relations between France and the United Kingdom, the question relating to the future arrangements for recognition and enforcement (i) in the United Kingdom of the judgments delivered by the French courts and (ii) British judgements, especially in France, is key.

Several scenarios are possible:

- maintaining the Brussels Ibis Regulation (REGULATION (EU) No 1215/2012 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 12 December 2012 on jurisdiction and the recognition and enforcement of judgments in civil and commercial matters) no longer as a Member State of the EU, but as a third State (like Denmark, which signed an agreement with the European Union on the recognition and enforcement of judgments in civil and commercial matters on 19 October 2005);

- Lugano Convention (revised 30 October 2007 on jurisdiction, recognition and enforcement of judgments in civil and commercial matters). The Lugano Convention extends the unitary rules of jurisdiction, recognition and ex equator to the EFTA States. This scenario is already known to the British since the United Kingdom left EFTA in 1973 when it joined the European Economic Community at the time (which became the EU in 1993). This would, however, require the agreement of the Lugano Convention States.

- negotiation of bilateral or multilateral agreements: The United Kingdom could consider negotiating bilateral or multilateral agreements on the recognition and enforcement of judgments with certain EU Member States, and in particular with its main economic partners. Presumably, such agreements would not have the effect of abolishing the ordinary enforcement procedure;

- ordinary law of exequatur: In this case, for a French court decision to be enforced in the United Kingdom and vice versa, that decision should be the subject of an exequatur procedure in the State in which it is sought to produce its effects. These procedures of enforcement of ordinary law, subject to the rules specific to each State, are in general very long, with a legal risk as to actual successful enforcement.

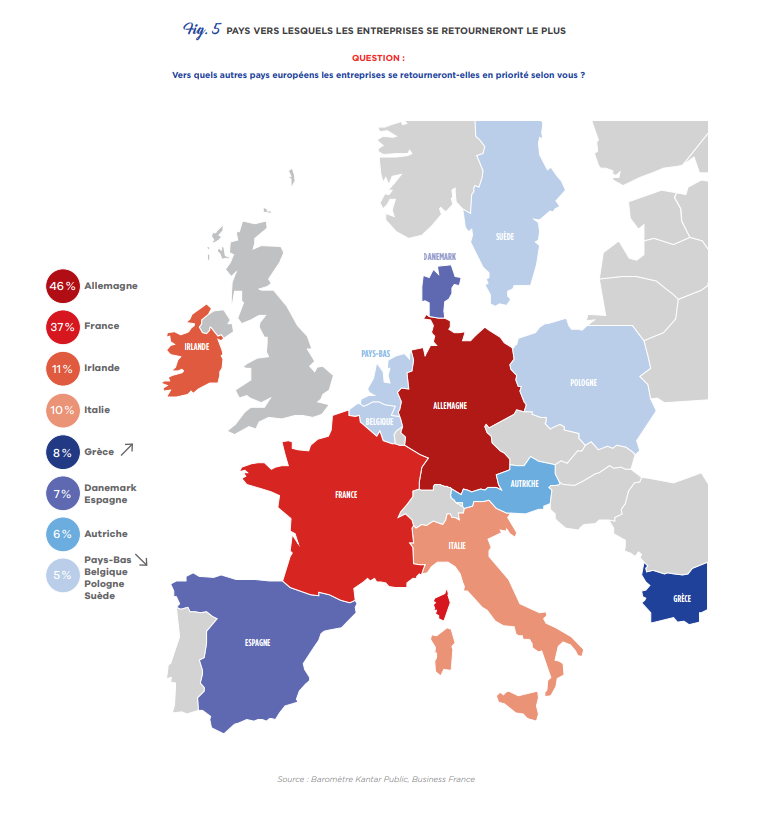

Projections for relocation of foreign investment in continental Europe

- Germany vs. France: According to the 2018 review published by Business France in April 2019, Germany was considered the main European beneficiary of Brexit (46%), while France (37%) remains the second most important destination for foreign investment in Europe.

- Netherlands: According the Netherlands Foreign Investment Agency (NFIA), the pace of business relocation to the Netherlands has been steadily increasing since the UK Brexit referendum. “140 companies have chosen to move to the Netherlands” since the London-Brussels divorce referendum. 78 made their decision in 2019”. According to the NFIA, these 140 companies plan to create a total of more than 4,200 jobs and generate 375 million euros of investments in the Netherlands in the first three years after their move.

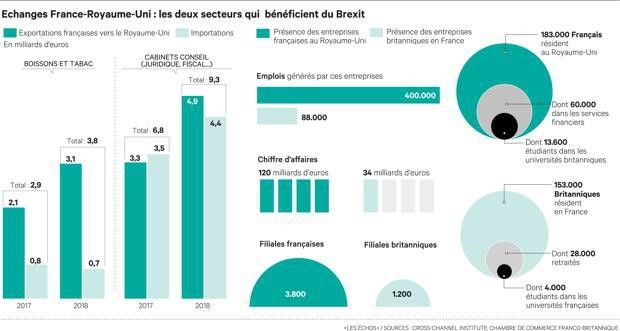

Some figures:

| 2018 | France --> UK | UK --> France |

| Trade surplus 12 Mds € |

French Exports: |

Imports from the UK: 20 Mds € |

| 2017 | France --> UK | UK --> France |

| Foreign Direct Investments (FDI) |

112 Md€ FDI stock in the UK 94 FDI projects |

90 Md€ FDI stock in France

118 FDI projects |

| 2016 | France --> UK | UK --> France |

| Cross-investments |

120 800 subsidiaires of French groups |

1 200 subsidiaries if British groups in France 34 annual turn over 88,000 jobs |